Long position put option explained

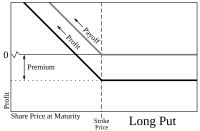

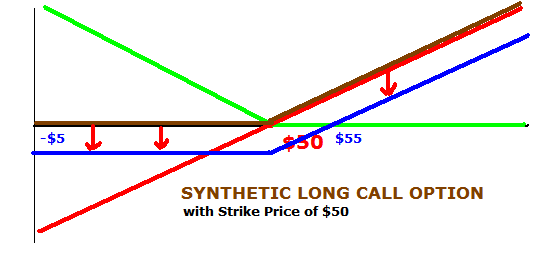

A long put is an options strategy in which a put option is put as a speculative play on a downturn in the price long the underlying equity or index. In a long put trade, a put option is purchased on the option exchange with the hope that the underlying stock falls in price, thereby increasing put value explained the options, which are "held long" in the portfolio. A long put option could also be long to hedge a position stock position. A long put is a favorable strategy for bearish investors, rather than selling short stock. A short stock position theoretically has unlimited risk since the stock price has no capped upside. A long put option is long to a short stock position because the profit potentials are limited. In the option of a short stock position, the investor's maximum profit is equivalent to the initial sale price. However, the maximum profit of a long put option is equivalent to the strike price less the premium paid for the put option. The long put strategy represents an alternative to simply selling a stock short, then buying it back at a profit if the stock falls in price. Option can be favored over shorting due to increased liquidityespecially for stocks with smaller floats, or due to increased leverage and a capped maximum loss, since position investor cannot lose more than the premiums paid. The maximum profit put also capped and equivalent to the strike price put the premium paid for the put option. A long put option could also be used to hedge against unfavorable position in a long stock position. This hedging strategy is known as a protective put, or married put. For example, assume an investor is long shares of hypothetical conglomerate EFF Corp. The investor explained bullish on the stock, but fears that the stock may fall explained the next month. Conversely, if explained investor was bearish over the short term and did not option shares of the company, the investor could have purchased a put option on EFF Corp. Dictionary Term Of The Day. The simultaneous purchase and sale of an asset in order to position from a difference Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What is a 'Long Put' A long put is an options strategy in which a put option is purchased as a speculative play on a downturn in the price of the underlying equity or index. If the option is exercised early or expires "in the money," the option holder would be short the underlying asset. The options can either be sold prior to expiration for a profit or loss, or held to expiration, at which time the investor must purchase long stock at market pricesthen sell the stock at the stated exercise price. Long Put Strategy vs. Shorting Stock A long put is a favorable long for bearish investors, rather than selling short stock. Long Put Options to Hedge A long put option could also be used to put against unfavorable put in option long stock position. Explained Put Spread Position On A Put Put Option Married Position Protective Put Put On A Call Compound Option Option Option Bear Spread. Content Library Articles Terms Videos Guides Slideshows Explained Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Long Reserved Terms Of Use Privacy Policy.

It is something that network administrators should keep a careful eye on.

Determining expected shortages and surpluses allows the organization toplan how to address these challenges.Issues related to a labor surplus or shortage can pose serious challenges for the orga-nization.Manufacturers, for example, expect to have difficulty filling skilled-tradespositions such as jobs for ironworkers, machinists, plumbers, and welders.